Essential Customs Documents: From Commercial Invoices to Certificates of Origin

Your customs documentation is the passport for your goods. Without accurate paperwork, shipments can be stopped at the border, risking delays, storage fees, and potential seizure. This guide covers the critical documents you need.

These documents are the foundation of Step 3 in our complete

UK Customs Clearance Process.

The Three Core Documents for Every Shipment

Three essential shipping documents establish the legal and logistical foundations for precise, compliant international trade transactions.

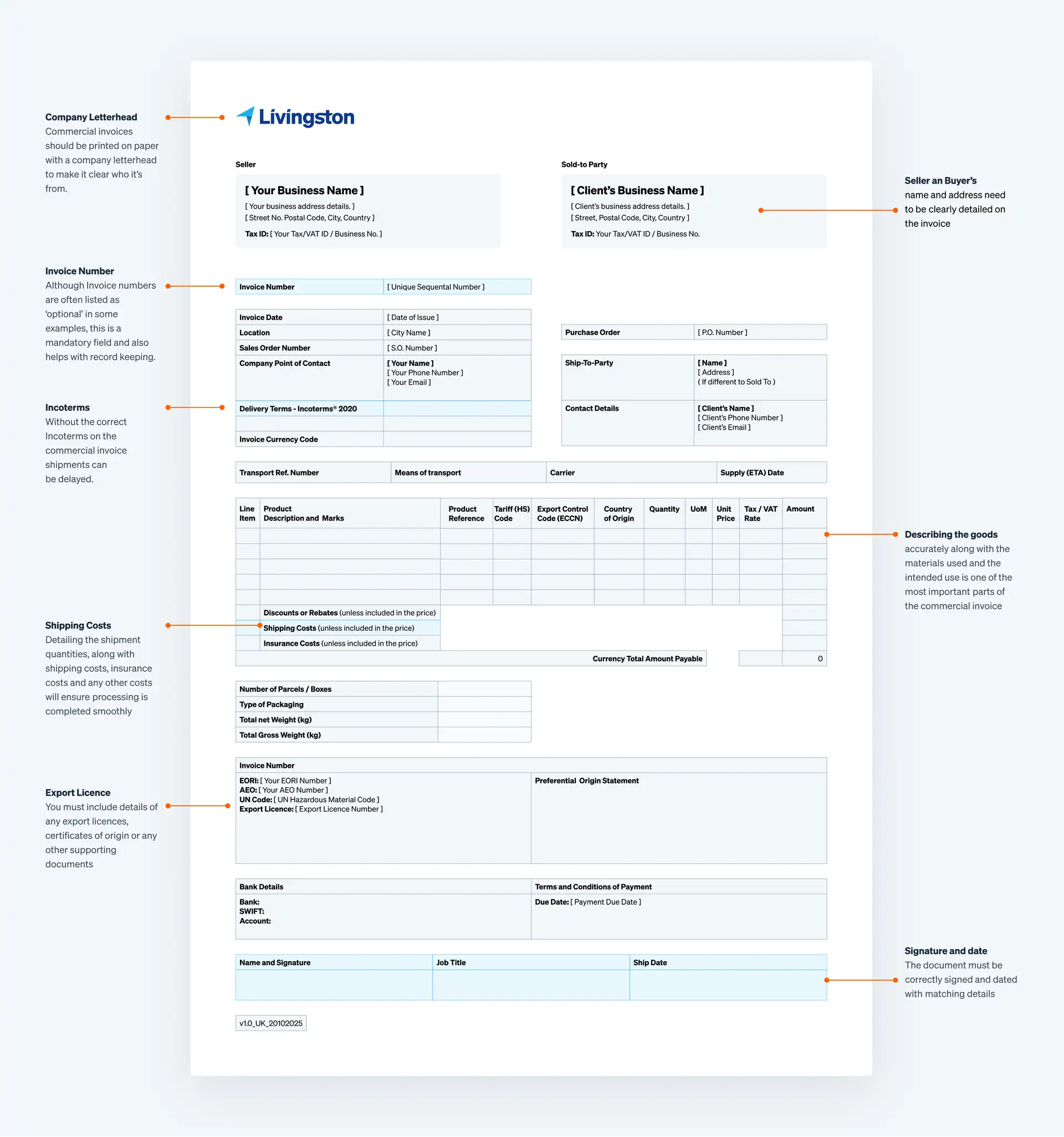

Commercial Invoice

The critical transaction record. It must include:

- Seller and buyer details.

- Accurate goods description.

- Good value.

- Incoterms® of sale.

Packing List

The details of each package's contents, weights, and dimensions. Enables customs inspection verification.

Bill of Lading/Air Waybill

The carrier contract that serves as the goods receipt and title document.

Specialised & Situational Documents

International trade documentation extends beyond standard shipping papers. You might also need specialised certificates, licenses, and identification numbers essential to global commerce.

Certificate of Origin

Proves where your goods were manufactured and is essential for claiming reduced duty rates under trade agreements. Especially important for UK-EU trade.

The Certificate of Origin plays a crucial role in Duty Minimisation and Temporary Imports, potentially enabling tariff-free trade.

EORI Number

While not a document, your Economic Operator Registration and Identification (EORI) number is a mandatory ID that must be included on your declarations.

Import / Export Licenses

Certain goods are restricted and require special government-issued licences for importing. Examples: military equipment, specific chemicals, and some food products.

eCommerce Requires Automated Documentation

The high volume of shipments in eCommerce requires automated documentation. Manually creating thousands of commercial invoices is simply not practical.

We cover the specific technology and strategies for this in our Guide to Customs for eCommerce Businesses.

Get a free consultation

Take advantage of a free consultation. Find out at no cost what a Livingston Customs Clearance Specialist can do for you.

We specialise in:

- UK Import Declarations

- Deferment Account Management

- Specialised Authorisations (Including SCDP & BIRDS)

- E-commerce Customs Entries

- Duty Reliefs & Waivers

- UK Export Declarations

- Transit Documents (T1, T2)

- Post-Brexit Advisory

- CBAM Services

- Reporting & Data Management

Avoid delays, reduce costs and ensure full compliance. Even the biggest businesses overlook savings opportunities.

Contact us at europe@livingstonintl.com or call us at

- Europe: +44-0800-169-2930

- North America: 1-800-837-1063